County auditors have been on the front line of the property tax problem in Ohio for numerous years. CAAO members from a diverse group of counties worked together to study solutions concerning the property tax problem, considering a wide range of perspectives and solutions dealing with valuation, tax rates and credits.

County auditors have been on the front line of the property tax problem in Ohio for numerous years. CAAO members from a diverse group of counties worked together to study solutions concerning the property tax problem, considering a wide range of perspectives and solutions dealing with valuation, tax rates and credits.

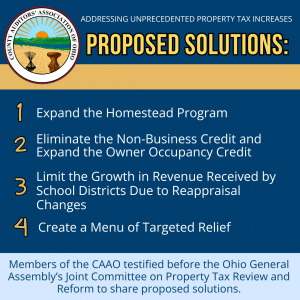

County auditors have proposed solutions to the Ohio General Assembly through the Joint Committee on Property Tax Review and Reform that include the following:

1. Expand the Homestead Program: Current law exempts taxes on the first $26,200 of property valuation for individuals 65 or older or permanently disabled who have an Ohio Adjusted Gross Income of $36,100 or less. The CAAO proposes increasing both the valuation that would be exempt from property taxes and the income threshold so that more individuals can qualify for the program. This will allow some of our most vulnerable Ohioans to stay in their homes.

2. Eliminate the Non-Business Credit and Expand the Owner Occupancy Credit: The State of Ohio pays a portion of qualifying property tax levies on behalf of residential and agricultural property owners, providing a 10% credit. The Non-Business Credit provides a 10% credit to all property owners with residential or agricultural properties, and the Owner Occupancy Credit provides a 2.5% credit to properties that are both owned and occupied as the individual’s primary residence. The CAAO would propose eliminating the Non-Business Credit as it often benefits for-profit owners, while expanding the Owner Occupancy Credit to a meaningful credit that would provide real tax relief to those homes that are owner-occupied.

3. Limit the Growth in Revenue Received by School Districts Due to Reappraisal Changes: Under Ohio law, school levies are subject to a floor that will not allow the tax rate to be adjusted downward when reappraisal increases occur. The CAAO proposes eliminating this hard cap on rate reductions and, instead, limiting growth on certain school levies to an inflationary index, containing revenue growth for districts operating at the 20-mill floor. As a result of this most recent valuation increase, many of the school districts operating at the floor received revenue increases in excess of 20%.

4. Create a menu of targeted relief: Create tax relief programs aimed to protect low to moderate income residents. These programs could include tax deferrals, income tax credits, or abatements based on a long-term resident’s inability to pay the ever-increasing tax burden.

Supporting Documents:

- Summary of Proposed Solutions

- Press Release Announcing Testimony (Joint Committee on Property Tax Review and Reform – May 22, 2024)

- Testimony Provided (Joint Committee on Property Tax Review and Reform – May 22, 2024)

- Link to Ohio Channel (Joint Committee on Property Tax Review and Reform – May 22, 2024)